Looking back at the hot-rolled strip market in June 2022, prices are running weaker. After the epidemic was gradually brought under control at the beginning of the month, the overall market demand has not improved significantly. In addition, international steel prices continued to decline, market confidence gradually declined, and prices continued to decline. Prices rose slightly repairing.

Looking forward to the hot-rolled strip market in July 2022, it is unlikely that the market demand will improve significantly in the traditional off-season, but most steel mills have reduced their output due to losses, and the contradiction between supply and demand may be alleviated. This article briefly summarizes the market in June 2022 from the perspectives of price, cost, supply and demand, and makes a simple prediction of the price trend of hot-rolled strip steel in July 2022, as follows:

1. Review of domestic hot-rolled strip steel market in June

In June 2022, the price of the national hot-rolled strip steel market will weaken. Although the epidemic situation has been effectively controlled, the market demand is still weak due to the influence of the rainy season. narrowed earlier. Specifically, in terms of narrow strip: the national average price of hot-rolled strip and narrow strip at the beginning of June 2022 was 4,890 yuan/ton, down 455 yuan/ton from 4,435 yuan/ton at the end of the month; in terms of medium and broadband: in early June 2022, the national hot rolling The average price of broadband was 4905 yuan/ton, down 459 yuan/ton from 4446 yuan/ton at the end of the month, and the price difference between wide and narrow strip steel narrowed slightly from 15 yuan/ton at the beginning of the month to 11 yuan/ton.

(1) Looking at the strip market from the billet market

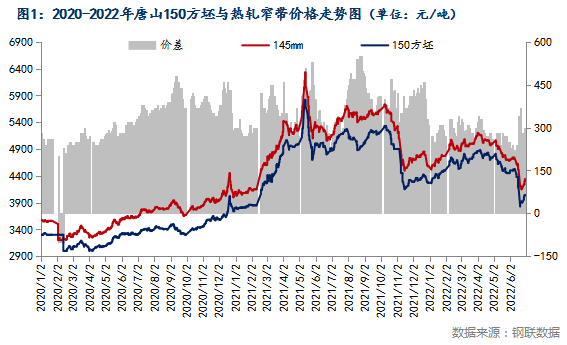

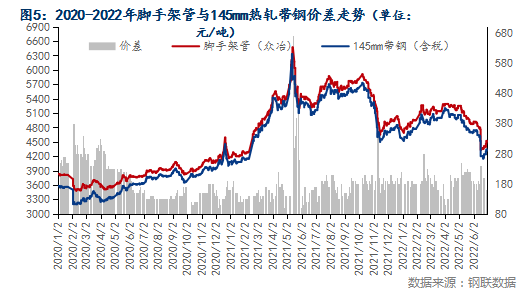

Judging from Figure 1, in June 2022, the prices of 145mm strip steel and steel billets both showed a trend of weakening. As of the end of June 2022, the price difference was between 200-370 yuan / ton, and the price difference basically remained low, but it was slightly higher than the previous period. repair. At present, the overall operating rate of billet-adjusting and rolling mills is still low, and the social inventory of steel billets is much higher than that of the same period in previous years. In addition, the steel mills are currently under great financial pressure and mainly ship out, so the overall price difference has been repaired. But the current downstream demand is not good, passive replenishment, so 145mm strip steel may have little room for a sharp rise in the short term.

(2) Looking at the steel strip market from the settlement price of the North China Strip Steel Conference

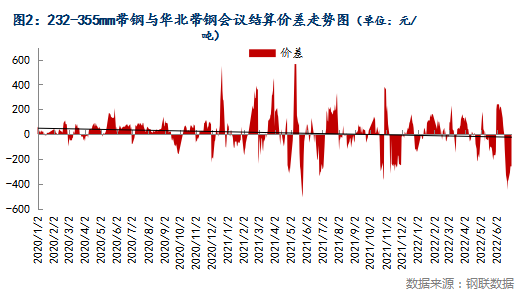

On June 24, 2022, the North China Strip Steel Conference was held. Based on the spirit of the North China Strip Steel Seminar on May 25, 2022, each company formulated the June strip settlement according to their own production and operation conditions and market conditions. The price and the guide price of strip steel in July are as follows: The settlement price of the North China Strip Steel Conference: In June 2022, the settlement price below 355 will be 4530 yuan/ton, 356-680 will be 4550 yuan/ton, and the price above 680 will be 4580 yuan/ton. Monthly guide price: 4400 yuan / ton, cash including tax, plus 70 yuan / ton for acceptance. Taking the market price of 2.5*232-355mm hot-rolled strip steel in Tangshan Hongxing as an example, the price in early June 2022 was higher than the settlement price of strip steel in North China, but the price reversed in the latter half of the year. There is still profit in the settlement this month. For the July market, due to steel mills reducing production agreement or discounts, after the pressure on merchants is reduced, there may be a price increase.

(3) Looking at the steel strip market from the price difference of major domestic regions

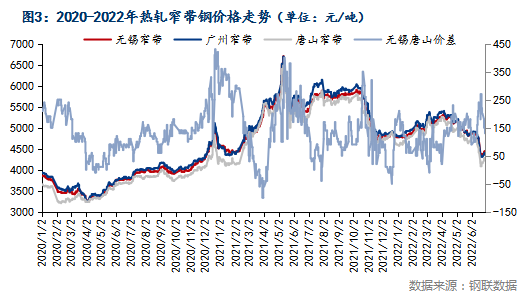

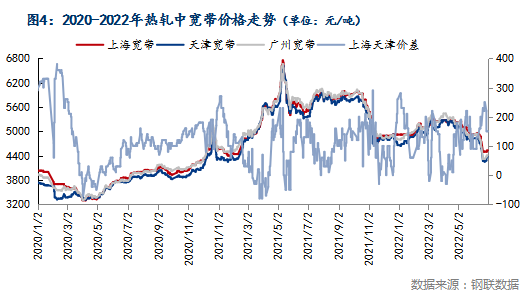

Judging from the price trend in Figure 3-4, the price of hot-rolled wide and narrow strips in the domestic market is running weaker, and the north-south price difference fluctuates widely with price changes. The monthly price difference is 90-270 yuan / ton. This month, the price of Tangshan, the main production place, was affected by the market and responded quickly. Prices in other regions followed. However, due to distance, market conditions and other reasons, the price in the south was lagging behind. As the price stabilized, the price difference between the north and the south narrowed for less time. Parts tend to be lower than normal. Although some of the northeastern resources going south have declined due to steel plant maintenance and later arrivals, the current price of hot coils in the south is lower than the price of hot-rolled strip steel, and the demand is still weak, so the north-south spread may remain at the current level or continue to narrow. .

(4) Looking at the strip steel market from the downstream market

From Figure 5, taking the Tangshan market as an example, in June 2022, the price trend of Tangshan scaffolding pipe and 145mm strip steel is basically the same, the price difference is maintained at 130-240 yuan / ton, and the cost is slightly inverted. On June 30, 2022, the investigation on the construction of scaffolding pipe manufacturers in Tangshan area is as follows: According to incomplete statistics, the number of production lines of scaffolding pipes in Tangshan area totaled 99, of which 94 production lines were stopped, and the operating rate was 5.05%, which was stable compared with last week. . Among them, 19 companies have completely stopped production, involving 43 production lines; 27 production companies have 56 production lines, and the actual operating rate is 8.93%. At present, in the off-season market, the overall capacity utilization rate of downstream rack pipe factories and square and rectangular pipes is relatively low, and the demand for 145mm strip steel is limited. July is still in the rainy season and high temperature weather, which still has a great impact on the terminal, so the downstream demand may still be weak, so the price of 145mm strip steel may continue to fluctuate weakly.

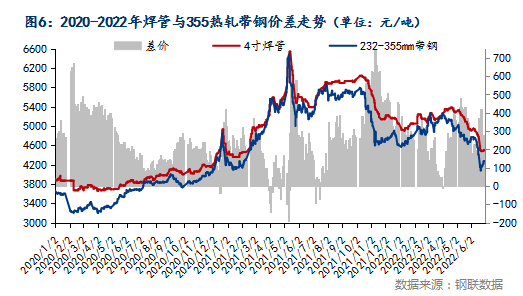

Taking Tangshan as an example, in June 2022, the price trend of 232-355mm hot-rolled strip and 4-inch welded pipe is basically the same, and the price difference of pipe and strip fluctuates greatly. between. In the middle of the year, the price of hot-rolled strip dropped sharply, and the price of pipe was relatively flat, so there was a large spread. However, as the market price gradually stabilized, the spread of pipe and strip returned to the normal level. At present, the transaction of the pipe factory is not smooth, so the inventory of raw materials and finished products is controlled at a low level, and the overall start-up is basically around 20-50%, and the pipe factory replenishes as needed. In July, some strip mills in Tangshan reduced production slightly, but the contradiction between supply and demand has not eased at present. As of June 30, 2022, according to Mysteel’s survey data, the operating rate of strip steel above 232mm was 51.85%, which was flat on a week-on-week basis and increased by 7.85% month-on-month; this week’s capacity utilization rate was 56.93%, a week-on-week decrease of 1.36% and a month-on-month increase of 7.18%.

2. Analysis of strip export form

In recent years, the volume of domestic hot-rolled strip in my country has gradually decreased. In addition, the demand for hot-rolled strip in foreign markets is not high, mostly for hot-rolled coil and cold-rolled steel. Therefore, the export volume of hot-rolled strip is compared with other varieties. On the low side, it mainly meets the production demand of the domestic market, but the export volume of hot-rolled strip steel in the form of end products in the light industry and hardware industry is relatively large.

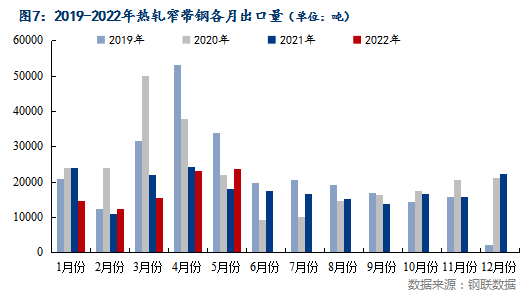

(1) Changes in exports of hot-rolled narrow strip steel

In May 2022, the export volume of hot-rolled narrow strip steel was 23,786.442 tons, an increase of 2% month-on-month and a year-on-year increase of 32%. In May 2022, the previous level will continue to be maintained, with a small increase. However, the international price has continued to fall recently, even lower than the domestic price, the price advantage has weakened, and exports may decline.

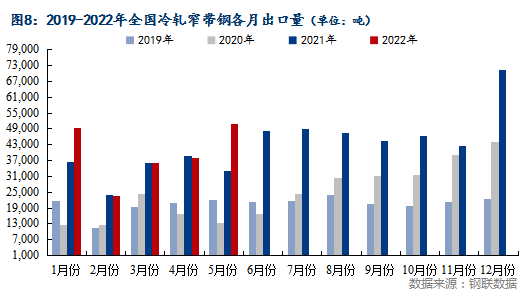

(2) Changes in the export of cold-rolled narrow strip steel

In May 2022, the national export of cold-rolled narrow strip steel was 50,779.124 tons, a month-on-month increase of 33.86% and a year-on-year increase of 54.25%. The export volume in May increased significantly compared with April due to the influence of the international environment. However, with the recent weakening of international steel prices, the export of cold-rolled narrow-strip steel in July may also be affected.

3. The domestic strip steel market may continue to fluctuate weakly in July

(1) Cost side

On June 29, 2022, the average cost of hot metal without tax for mainstream sample steel mills in Tangshan was 3,388 yuan/ton, and the cost of strip steel was about 350 yuan/ton. In terms of raw materials, the coke has been raised by 200 yuan/ton, and the profit of the steel mill has been slightly repaired, but the cost has no support for the price at present.

(2) Supply side

As of June 30, 2022, the operating rate of Mysteel’s 63 hot-rolled strip steel production enterprises was 58.76% this week, +2.06% week-on-week; -3.09% month-on-month; capacity utilization was 61.20%, week-on-week -2.02%; Month-on-month -2.79%; this week’s actual output of steel mills was 1.4845 million tons, week-on-month -49,100 tons; month-on-month -67,600 tons; steel mill inventory was 319,600 tons, week-on-week -26,400 tons; month-on-month -27,700 tons. Although the output is lower than the same period of previous years, the current steel mills are under great financial pressure, so low-cost orders are mainly accepted. Coupled with the inversion of costs, there is still an expectation of production cuts in the later period.

(3) Demand side

July is still in the traditional off-season, and the demand may not be improved due to the rainy season. At the end of the month, as the rainy season comes to an end, the demand for cold-rolled galvanized strip may recover. However, the international price has continued to weaken recently. increase again.

(4) Inventory side

As of June 30, 2022, the total sample inventory of hot-rolled strip steel in the country this week was 1,083,600 tons, a decrease of 46,500 tons from last week, an increase of 19,500 tons from the same period last month, and an increase of 396,300 tons from the same period last year. At present, the overall national inventory of hot-rolled strip is still higher than the same period of previous years, but with some steel mills reducing production, the inventory has decreased slightly. At present, the inventory pressure of merchants is still relatively large, but there are also some state-owned enterprises hedging resources. After the profit from the current price difference in the later period, the inventory may drop sharply.

(5) Macroscopic view

1. Premier Li Keqiang presided over an executive meeting of the State Council to determine measures for policy-based development financial instruments to support the construction of major projects, and to expand effective investment to promote employment and consumption. The meeting decided to use policy and development financial tools to raise 300 billion yuan through the issuance of financial bonds, which will be used to supplement the capital of major projects or bridge the capital of special debt projects. The central government will give appropriate discounts.

2. The Office of the Leading Group for Logistics Guarantee and Smoothness of the State Council has issued a notice to deploy to do a good job in ensuring energy transportation during peak summer. Expressway toll stations involving electricity and coal transportation should open all toll lanes to maximize the capacity and efficiency of toll stations. In terms of railway transportation, various measures have been taken to improve the efficiency of thermal coal unloading. In terms of water transportation, it is necessary to strengthen the monitoring, analysis and judgment of coal shipments and port storage in key ports such as the four northern ports.

In March and June, the Caixin China Manufacturing Purchasing Managers Index (PMI) recorded 51.7, 3.6 percentage points higher than that in May, ending the contraction trend of the previous three months and returning to the expansion range, and is the highest since June 2021 .

To sum up, in July 2022, the hot-rolled steel strip market will be affected by the rainy season and high temperature weather, and it may still be difficult for the demand to improve significantly; the social inventory is much higher than that of the same period of previous years, and the manufacturers are under great pressure; Steel mills have plans to reduce production, supply has gradually declined, and the contradiction between supply and demand may be alleviated. But the current international steel prices continue to fall, or affect the domestic market prices. To sum up, it is expected that the hot-rolled strip market may continue to fluctuate weakly in July.

Post time: Jul-04-2022